Someone Just asked yesterday; What Forms of business organization are Right for an Income Earner?. Meanwhile, you Need this Guide to be Successful in the Right Choice of Business you Need to start Be it a Small or Big Organization.

On this Note; One of the important steps to take when thinking of How to start a small business is to pick the form of business organization you want to Maximize Passive Income(Profit). Well, different forms of business cover different legal securities to the owner when it comes to liabilities of the debts from the business. Another difference lies in their method of paying taxes.

Therefore it is prudent to make the right choice of form of business organization that will fit with the type of business you will want to start.

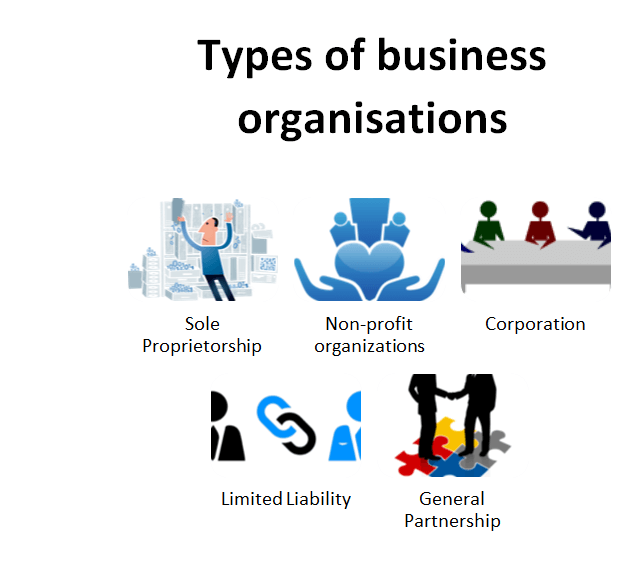

Two forms of business organization exist, namely;

- Limited liability Entities

- Unlimited Liability Entities

Liability simply refers to an obligation arising from a past business event. In other words, it means an obligation a business owes another business in the course of a previous business transaction.

Examples of a liability

- A service not rendered

- An obligation to supply goods.

- Debt to a company or an individual

- wages payable

- Loan from the bank

- Mortgages e.t.c.

Therefore, the major difference between different forms of the business organization lies in the responsibility of the owners to settle the above-mentioned debts if anything should happen to the business.

Unlimited Liability Entities

Unlimited Liability entities are business forms that have no legal protection on the personal properties of the owner if anything should go wrong with the business (including personal cars or houses). Therefore, the owner or owners of the business will be held accountable for the debts owed by the company.

2 business types are under this category;

Sole Proprietorship

This is a type of business entity owned by an individual. The sole proprietorship is a business legally treated as the same as the owner. There is no distinction between the business and its owner. Both operate the same account, same assets, and Liabilities.

According to Chron, Sole proprietorship makes up about 73 percent of all small businesses because it requires a small capital and it is easy to start. Also, the profit and management of the business solely depend on the owner.

However, the limitation of this type of business are;

- As a sole proprietor, you must report all business income or losses on your income tax return; the business and the owner share the same taxation. Read More…

- There is no legal form of protection for the personal assets of the business owner. This means that the owner can lose personal belongings as an obligation to the business.

- It is a risky form of business and losses are borne alone.

- It cannot be incorporated and therefore getting a business name is difficult. However, you can get a legal business name by filing a “Doing Business As” (DBA). This can allow you to open a business account with your business name.

General Partnership

Another form of business under this category is General partnership; It is a similar form of business to a sole proprietorship. The difference is that its members are from a minimum of 2 up to 50 members.

In General partnership, Partners often enter into a partnership agreement to share in assets, profits, and legal liabilities of their business. In other words, any of the partners can be liable for the debt of the company with his/her assets.

The advantage of this form of business is that the partnership is not always that complex. It is also cheaper and easier to establish when compared to Limited Liability companies. However, the disadvantage is that the Partnership can be dissolved by death or break-apart of a partner unless stated otherwise in the partnership law.

Limited Liability Companies

Most times people often confuse LLC with a Corporation. LLC is a hybrid of sole proprietorship or partnership and a corporation. Both LLC and Corporation, however, protect their owners from liability for business obligations. The liability here is Limited in the sense that any legal action will only affect your input to the business and not your assets. But they are different in their management, ownership, and method of taxation.

Differences between a Limited Liability Company and a Corporation

- Corporations issue shares of stock to individuals known as shareholders while LLCs share their stocks between owners known as members.

- Transfer of shares is easier with a corporation, unlike the Limited Liability Company where a member cannot transfer the shares to another.

- The management of a corporation is more rigid than that of a limited liability company. The Management of corporations is by the “Board of directors” while in LLC, members contribute to its management.

- Corporations can pay tax as a C corporation or S corporation. The C corporation type of taxation is “double taxation”. In Double taxation, the Shareholder pays tax both at the Corporate level and also from dividends received from the business. The S Corporation type of taxation is for smaller corporations, they pay tax based on the share of the profits from the company. However, In LLCs, They pay their tax as personal tax returns.

Since we have known the difference between a Limited liability Company and a Corporation, let’s talk about the different types of Limited Liability Companies. They are as follows;

1. Limited Liability Partnership (LLP)

This is another form of partnership that is different from the general partnership. In a general partnership, the partners are individually accountable for the misconduct or Negligence of the Company. This is different from a Limited Liability partnership where all the partners are liable for the action of the business.

The LLP is a form of business usually popular among a group of professionals in agreement with the services they render. Examples include; lawyers, accountants, and architects.

2. Private Limited Company (PVT.LTD)

It is a type of company limited by shares. The shares of a private limited company are distributed to a group of people such as a family but not the general public. Therefore, the laws governing the Private Limited liability companies are not as stringent as that of the Public limited liability company.

The Private limited liability company has only one business leader always referred to as the Boss.

One advantage of a PVT.LTD over LTD is that the former cannot disclose its financial operations to the public whereas LTD provides its financial information to the public.

3. Public Limited Liability (LTD)

A public limited company is owned publicly by a large number of investors. Unlike the Private Limited liability company, their stocks are traded in open markets among investors. They can easily raise capital through the sale of securities.

This types of business have a higher tendency of continuation than other forms of business because its shares are open to the public.

The limitation of this type of business is its complexity and the start-up capital is huge about other forms of business.

Limited Liability Company Form Filling Requirements

- LLC Organizational Forms

- Initial Meeting and Capitalization of the LLC

- Get an EIN for LLC

- Open a Bank Account

- LLC Maintenance Forms

However, you can make it from the start to the ending to fill the Legit Limited Liability Company Form just as the steps here describe:

LLC Organizational Forms

This is the first stage of filling a Legit Limited Liability Company Form and on this page, you will these two steps to take on the Go:

- LLC Articles of Organization for any state. Get Now!

- LLC Articles of Organization for your LLC in Guam. Get Now!

The One you have selected from the Above list will contain the LLC Form which you have to Fill and it is for any state(No.1). while the second is specified.

Initial Meeting and Capitalization of the LLC

This brings the second stage, Giving you the full details on what you need to know about the initial meeting and capitalization of LLC and More are:

- If your LLC holds annual meetings, use this meeting minutes template to track it. Get Now!

- A limited liability company operating agreement for any state. Get Now!

- Limited liability operating agreement for any state specifically written for a manager-managed LLC. Get Now!

- Limited liability operating agreement for any state specifically written for a single member-managed LLC. Get Now!

- Limited liability operating agreement for any state specifically written for a multiple member-managed LLC. Get Now!

- Document initial contributions to the LLC by all members using either the LLC’s operating agreement or this LLC capital contribution template. Get Now!

- A limited liability company membership certificate. Get Now!

Get an EIN for LLC

An EIN stands for “Employer Identification Number” and is just a type of Taxpayer Identification Number (TIN) that identifies your LLC with the IRS. and More is that An easy way to think of an EIN is that it’s like a “social security number” for your LLC.

More to get from this stage three on this page are in the list below:

- Obtain An EIN For Your Limited Liability Company – Free For Download

Open a Bank Account

On filling a Legit Limited Liability Company Form you will need to open an account to support your business on the go. Well, Opening an Account can be made easier for you if you can follow the right path to create LLC Bank Account.

LLC Maintenance Forms

Now, we talk About the Maintenance forms because anything on earth that lacks maintenance will not last in the long run. Well, this stage brings the Whole LLC Form Filling in summary with these list of things:

- LLC Members can use this document to make resolutions for the limited liability company. Get Now!

- Managers of an LLC that have been granted authority by its members can make resolutions using this form. Get Now!

- Make changes to your LLC’s Articles of Organization, Certificate of Formation, or Certificate of Organization using these Articles of Amendment templates. Get Now!

- Amend your LLC’s operating agreement at any time with this form. Get Now!

- If you’re looking to fund an LLC with personal assets in exchange for a membership interest, use this template to show their value as a contribution to the initial capital. Get Now!

- If you want to sell your LLC, you can sell your membership interest in the LLC using this bill of sale template. Get Now!

REGISTRATION OF COMPANY, BUSINESS NAME, INCORPORATED TRUSTEES

- Reserve name.

- Login with your profile.

- Select ”REGISTRATION”

- Select the classification that is ”BUSINESS NAME, or COMPANY, or INCORPORATED TRUSTEE”.

- Enter the availability serial code.

- Click on continue.

Summary

When choosing the structure and form of business to go into, It is important to bear the following at the back of your mind.

- The level of legal protection you can get from the business on your assets.

- How the business pays its tax.

- The flexibility of the management system.

- Continuity of the business.

However, the Box below can help you more to get all you want in the blink of an eye because as you ping us with the box, you will get your instant response also.